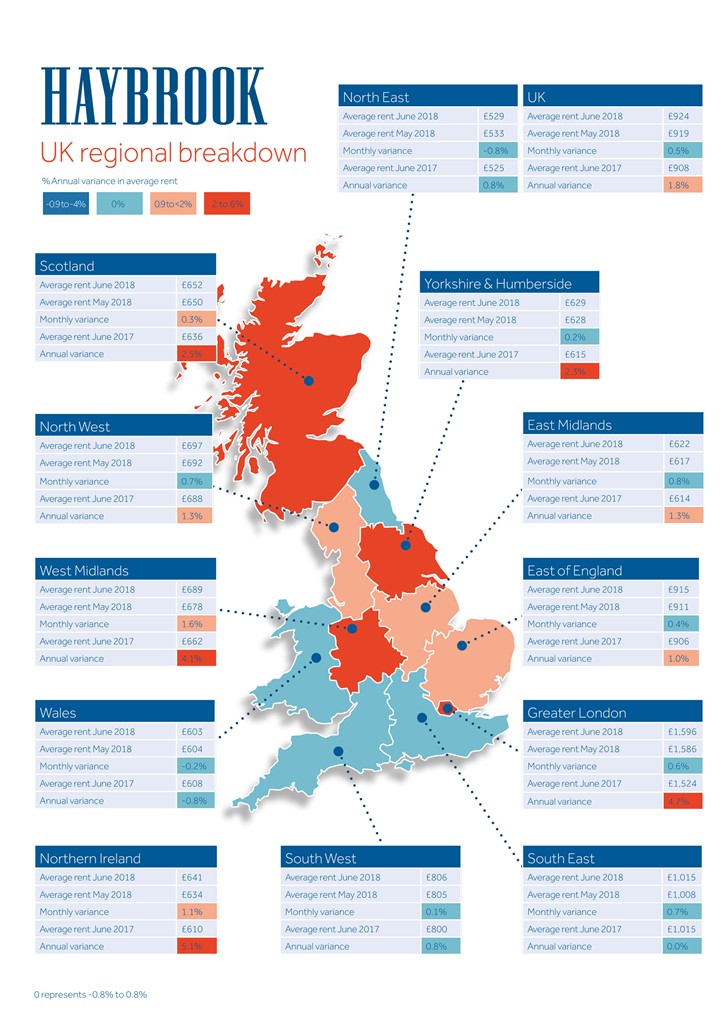

Latest rental price and property growth trends reveal market is performing well for both landlords and tenants

Haybrook comments:

- Average rents across the UK rose by 1.8% in June 2018 when compared to the same month a year previously; the average monthly rent is now £924

- Rents in London increased by 4.7% in June 2018 than in the same month of 2017; the average rent in the capital now stands at £1596 a month

- When London is excluded, the average UK rental value was £767 in June 2018, this is up 1.3% on last year

- May's Rental Index reveals that rents rose in 10 out of the 12 regions covered in the research

The official inflation figure remains at 2.3%, whilst according to the ONS wages rose by 2.7% in the three months to May. This means in real terms, tenants should not feel the impact of average rental price rises.

Meanwhile property values continue to rise – albeit at a continually reduced rate. Prices across the UK are on average 3% more than a year ago meaning they’re rising faster than inflation and wage growth. This is positive for a landlord looking for property price growth over the longer term.

House prices are also on the rise – but growth is reducing

Average house prices in the UK have increased by 3.0% in the year to May 2018 (down from 3.5% in April 2018). This is its lowest annual rate since August 2013 when it was also 3.0%. The annual growth rate has slowed since mid-2016 and has remained under 5%, with the exception of October 2017, throughout 2017 and into 2018.